GCash5.95.0

Mynt - Globe Fintech Innovations

Mar 23, 2012

December 1, 2025

230.83 MB

5.95.0

Android 6.0

100,000,000+

Description

Why GCash APK is the Essential E-Wallet for Filipinos

GCash APK is a mobile e-wallet application available for both Android devices, enabling users to perform key financial transactions such as money transfer, bill payment, load purchase, and seamless access to digital services primarily in the Philippines. If you’ve ever felt stuck staring at a long queue at a payment center, or scrambled to borrow cash for bills, you’ll immediately understand the appeal. GCash packs speed, versatility, and convenience into one portable app, easing everyday money woes without the fuss. As someone who hates clutter in their digital life, I appreciate that GCash combines so many features under one roof, from paying bills to purchasing prepaid health insurance. Simple, right? Even my aunt formerly terrified of anything with a password now prefers it to handing cash to a real person. The app fits the fast-paced, always-online lifestyle of young people, professionals, even hustling students. In short, GCash offers a handy way to live, pay, and thrive, all cash-free.

Standout Financial Tools in the GCash Android E-Wallet

GCash stands out by offering a comprehensive range of features. Think of it as a digital Swiss Army knife for your money needs. You don’t need deep pockets or tech wizardry, just a smartphone and a desire for simplicity.

Money Transfers

GCash allows users to move money quickly and securely. The app features:

- Free GCash-to-GCash Transfers: Move funds between accounts instantly without extra fees. Perfect for sending allowance to siblings or splitting the cost of pizza with friends.

- Send to Many: Distribute cash to multiple recipients at once. This comes in handy for freelancers, small businesses, or for organizing group outings where everyone needs to chip in.

- Bank and E-Wallet Transfers: GCash links to major Philippine banks and other e-wallets, including Maya, BPI, BDO, UnionBank, Landbank, Metrobank, and Chinabank. You can save account details for repeat transactions, making recurring payments a breeze. • Real-Time Processing: Users enjoy speedy, almost instant fund availability, which means less waiting and more doing.

The process is easy. You pick an amount, select the destination GCash wallet, bank, or connected e-wallet and the money moves with minimal taps. GCash enables safe and rapid transfers for almost any scenario, from urgent bill splits to last-minute tuition payments.

Buy Load and Digital Services

GCash does not stop at money transfers. It also empowers users to purchase load and digital services right from the app.

- Supports All Mobile Networks: Globe, TM, and other providers are covered. This means easy reloads for you or anyone else regardless of mobile carrier. I often help my younger cousin load her phone when she runs out at the worst possible time.

- Exclusive Promos: GCash users accessing Globe and TM benefits receive special offers not found elsewhere, making top-ups a little sweeter for existing subscribers.

- Broadband, TV, Insurance, and More: Users can purchase load for broadband internet, subscribe to TV channel packages, or buy prepaid health insurance. GCash expands beyond regular load purchase options and covers a diverse digital ecosystem.

- On-the-Go Convenience: Buying load from anywhere secures connectivity without stepping outside or searching for a sari-sari store.

The ability to purchase a range of digital services makes GCash a favorite among those who value constant communication and access to the internet.

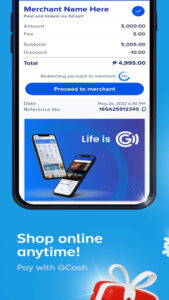

Quick and Hassle-Free Bill Payment with GCash in the Philippines

Paying bills used to require half a day and nerves of steel. GCash turns this headache into a quick, painless experience. It streamlines monthly obligations and gives more control to users who thrive on organization.

Pay Bills to Multiple Billers

GCash works with a network of over 400 billers. This includes:

- Electricity and water utilities

- Internet and telecommunications providers

- Loan and insurance companies

- Educational institutions and government agencies

You can handle almost every bill in one unified place. Forget printing receipts or searching for cash. With just a few taps, you can pay early, on time, or even past the due date. Late-night realizations that you forgot the water bill are no longer a crisis.

Automated and Flexible Payment Options

GCash lets users set recurring payments and reminders to manage regular bills. This automation saves time and brain space.

- Saved Billers: Store your most-used billers for faster checkout. No more typing long account numbers every month.

- Bill Payment Reminders: Notifications keep you on schedule, reducing the chance of forgetting important payments.

- GCredit Integration: Users can cover bills even with a low GCash balance, thanks to GCredit, the app’s built-in credit line.

GCash users gain greater control over cash flow and avoid service interruptions caused by missed due dates.

Who Thrives with GCash APK: Ideal Users and Everyday Applications

GCash appeals to a diverse audience. Its design suits both entry-level smartphone users and more advanced digital natives.

Ideal User Profiles

- Young People and Students: Perfect for those who need quick access to load, digital funds, and cashless payments but don’t have credit cards.

- Freelancers and Gig Workers: Flexible transfer features allow managing income from various projects or platforms.

- Families and Households: Organize group bills, share household expenses, and send allowances with ease.

- Small Business Owners: Manage bulk payouts and receive payments through a secure, documented channel.

- Office Professionals: Pay bills, reload phones, or transfer money without breaking the workday routine.

GCash bridges age groups and income levels. From teenagers paying for mobile games to adults handling household budgets, the app adds value.

Practical Applications

Here are a few real-world examples showing how GCash fits into everyday life in the Philippines:

- A student uses GCash to pay for tuition and buy mobile load in one sitting. No waiting at banks or asking parents for help.

- A freelancer receives client payments on GCash, then pays bills and reloads data without visiting a single payment center.

- An office worker settles monthly utility bills and loans, sets reminders, and avoids the pain of late charges.

- A household helper sends remittances to family in the province through a few taps and gets instant confirmation.

GCash connects users to practical solutions for daily living.

Why GCash Outshines Other Philippine E-Wallets for Android Users

When you bundle so many financial services into one tidy Android app, the advantages quickly pile up. Let’s cut to the essentials.

All-in-One Financial Platform

GCash is more than just an e-wallet. It’s a single platform that manages:

- Transfers between wallets, banks, and other e-wallets such as Maya

- Mobile load and data purchases for all networks, including prepaid services for Globe and TM

- Payments for over 400 billers, from utilities to tuition

- Reminders and automation for better financial habits

The compact design reduces clutter on your phone and consolidates personal finance operations. You get more done with fewer apps and less hassle. I’ve personally ditched two banking apps after realizing GCash did their job plus more.

Accessibility and Savings

GCash gives users savings both in time and in actual cash by offering:

- No Extra Fees: Free wallet-to-wallet transfers and discounted promos save users money over time.

- Universal Access: Available anywhere in the Philippines with mobile data or Wi-Fi. No more searching for payment centers or banks.

- Smart Features: Reminders, automation, and account management tools make it easy for forgetful types like me to keep on top of everything.

- Convenience: All services are in one pocket-friendly application.

Here’s how GCash stacks up in key areas:

| Feature | Key Benefits |

| Money Transfers | Free, instant GCash-to-GCash, support for many banks and e-wallets, send-to-many feature |

| Buy Load | All networks covered, exclusive promos for Globe/TM, broadband, TV, and insurance included |

| Bill Payments | 400+ billers, automated reminders, recurring billing, GCredit support |

Savings come not only from cost but from the effort spared. GCash’s simple interface trims the fat off every financial transaction, whether it’s a money transfer or a quick broadband internet top-up.

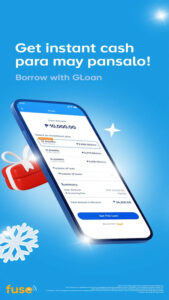

How GCredit by GCash Expands Your Financial Options

Sometimes life throws a curveball and your digital wallet comes up empty. GCredit offers a solution right inside GCash, so you’re never caught off-guard.

What is GCredit?

GCredit is an internal credit line within GCash. Qualified users can borrow funds directly through the app when their balance runs low. It’s not unlike having a small emergency fund that’s always there, tucked discreetly into the app, waiting for a rainy day or an unexpected bill.

- Accepted by Select Billers: Use GCredit to settle bills and services, making it much more flexible than standard cash advances. Whether it’s bill payment, load purchase, or buying prepaid health insurance, GCredit adds flexibility.

- Automated Approval: The more you use GCash responsibly, the easier it is to access GCredit. Good payment habits pay off in a system designed to reward responsible e-wallet management.

GCredit expands the app’s usefulness beyond what’s possible with prepaid balances alone.

Benefits of GCredit

GCredit delivers real advantages, especially for users managing fluctuating budgets:

- Access: Use GCredit to pay bills even with zero wallet balance. No racing to top-up in a panic.

- Flexibility: Repay borrowed amounts in sync with your cash flow, reducing financial stress. Even unexpected expenses can be covered without borrowing from friends or family.

- Convenience: All borrowing and repayment processes are kept inside the app no forms, collaterals, or in-person meetings.

- Credit Building: Consistent use and repayment build a stronger credit profile, opening up improved future offers.

GCredit makes GCash not just an e-wallet, but a reliable short-term backup for sudden money needs.

GCash APK on Android: Smart Finance for Life in the Philippines

GCash APK is a powerful Android e-wallet app that simplifies financial management for users in the Philippines. It lets you:

- Move money fast across GCash accounts, major banks like BPI, BDO, UnionBank, Landbank, Metrobank, Chinabank, and other e-wallet options such as Maya.

- Buy prepaid load, broadband internet, TV, and health services on the fly.

- Pay bills for over 400 service providers with reminders and recurring options.

- Access a built-in credit line with GCredit for emergencies or tight months.

GCash stands as a trusted hub for daily finance. It brings unmatched convenience to people like students, freelancers, families, and businesses, saving both time and money through mobile-first solutions. As someone who prefers convenience and hates hidden charges, I count on GCash for everything from last-minute bill payment to spontaneous road trips funded by digital banking.

If you want a digital wallet that keeps up with your fast life and gives you smart, integrated features, GCash deserves a space on your device. Give it a shot the only thing you might lose is the urge to stand in long lines again.

Images